In the evolving landscape of finance, where every tick of the market can spell opportunity or disaster, the allure of trading captivates many. Yet, for beginners, the leap from theory to real-world application can be daunting.

Enter simulated trading—a unique approach that allows aspiring traders to dive into the tumultuous waters of the stock market without risking hard-earned cash. But can you truly hone your skills in this virtual realm? Is it possible to gain the nuanced understanding that comes from real trading experiences, or will practice in a simulated environment foster a false sense of security?

As we explore the world of simulated trading, you’ll uncover the advantages, pitfalls, and essential strategies that can pave your way to becoming a confident and capable trader, all while navigating the exhilarating yet unforgiving tides of the financial markets.

The Benefits of Simulated Trading

Simulated trading offers a unique pathway for beginners eager to immerse themselves in the complexities of the financial markets without the daunting risk of losing real money. By engaging in a risk-free environment, traders can experiment with various strategies, learning the nuances of market behavior and their emotional responses to simulated losses and gains.

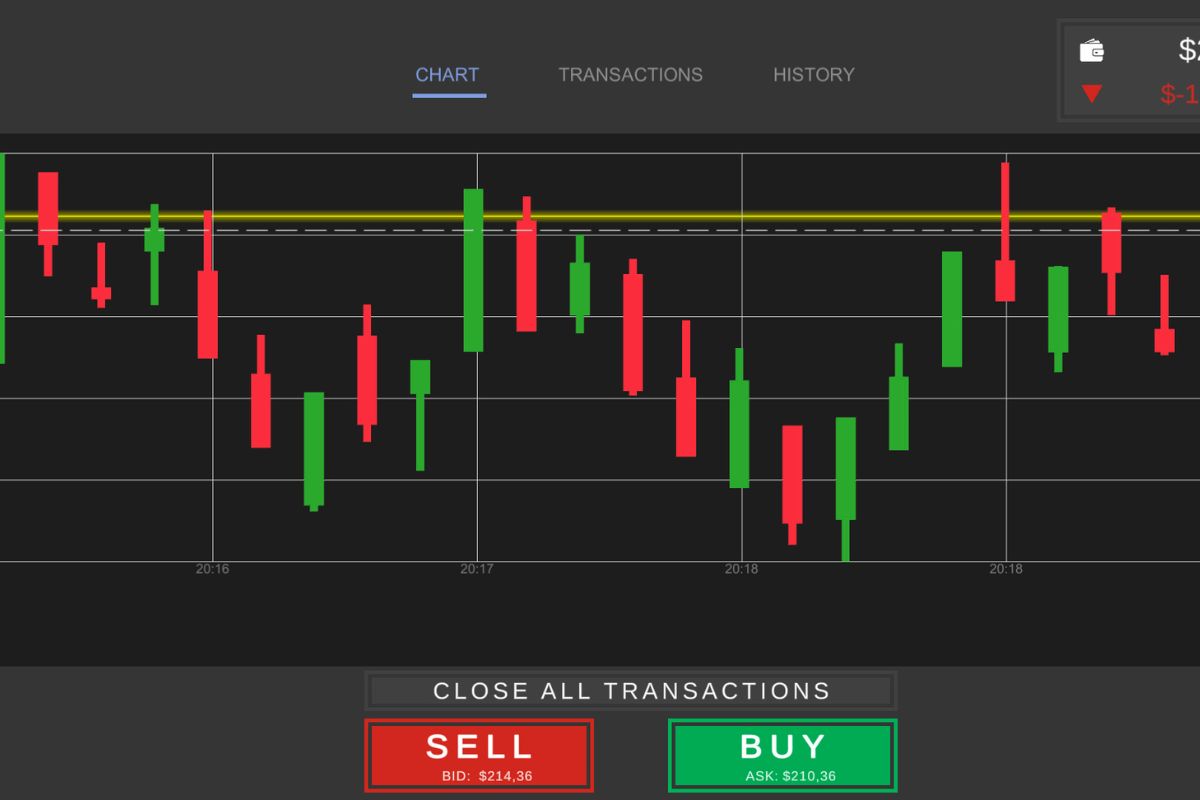

For those looking to deepen their understanding of market mechanics, tools like DOM charts (Depth of Market charts) add an invaluable layer of realism. These charts allow traders to visualize order flow, including buy and sell orders at various price levels, providing critical insights into liquidity and market sentiment.

By integrating DOM charts into simulated trading, users can practice executing trades with precision and learn how market depth affects pricing and volatility, preparing them for the demands of live trading environments. Picture this: you place trades, tweak your approach, and analyze outcomes—all while receiving immediate feedback that sharpens your decision-making skills.

Unlike traditional methods of learning through textbooks or lectures, simulated trading allows for an interactive experience where trial and error forge confidence and competence. It’s a playground of sorts, where the stakes are low, yet the lessons are profound, paving the way for a smoother transition into live trading when the time is right.

How Simulated Trading Works

Simulated trading, often referred to as paper trading, operates as a risk-free environment where beginners can practice their skills without the fear of immediate financial loss. In this virtual arena, traders are provided with real-time market data and can execute trades using fictitious money, enabling them to experience market dynamics and hone their strategies.

Picture this: with just a click, you can buy and sell stocks, test technical analyses, and even experiment with different investment styles—all without any consequences to your wallet. For those jittery about the unpredictable nature of the markets, simulated trading serves as a valuable training ground, fostering confidence and insight.

Whether you’re contemplating long-term investments or day trading, this hands-on approach allows you to make mistakes, learn from them, and refine your techniques until you’re ready to dive into the real world of trading.

Setting Up Your Simulated Trading Account

Setting up your simulated trading account is your first step into a realm where theory meets practice without the risk of real financial loss. Begin by selecting a reliable trading platform that offers robust features, user-friendly interfaces, and comprehensive educational resources.

Most platforms will guide you through the account creation process, which typically involves providing some basic personal information and verifying your identity. Once your account is live, you’ll often have the option to choose from various simulated trading environments, each mimicking real market conditions—some even provide virtual funds to maneuver with.

Take your time to explore these features; dive into tutorials, practice making trades, and familiarize yourself with the tools at your disposal. Remember, this is your sandbox—experiment boldly, learn from every misstep, and build your confidence before transitioning to the real world of trading.

Conclusion

In conclusion, simulated trading serves as a valuable tool for beginners looking to enhance their trading skills without the financial risks associated with real money. By providing a risk-free environment to practice and refine strategies, traders can build confidence and gain a deeper understanding of market dynamics.

Tools such as DOM charts (Depth of Market) further enrich this learning experience, allowing users to analyze order flow and liquidity in real time. While simulated trading cannot fully replicate the emotional and psychological pressures of real trading, it undeniably equips novices with the knowledge and experience necessary to transition into live trading with greater assurance.

Ultimately, with dedication and the right resources, aspiring traders can effectively leverage simulation to lay a strong foundation for their financial endeavors.