In the fast-paced world of trading, the quest for success can often feel overwhelming, especially for newcomers navigating the intricate webs of markets and strategies. Yet, the journey doesnt have to be fraught with peril.

Imagine stepping into the world of trading armed with tools and techniques designed to minimize risk while maximizing your learning potential. This article delves into innovative and effective approaches to practice trading without the fear of financial loss.

From leveraging simulation platforms to understanding the importance of a strategic mindset, well explore various methods to enhance your skills. Each tactic aims to not only bolster confidence but also foster a deeper understanding of market dynamics.

Let’s embark on this journey towards becoming a savvy trader, one deliberate step at a time.

Understanding Risk Management in Trading

Understanding risk management in trading is crucial for both novice and seasoned traders alike, as it lays the groundwork for a sustainable trading strategy. At its core, risk management involves identifying, assessing, and mitigating potential losses in your trading portfolio.

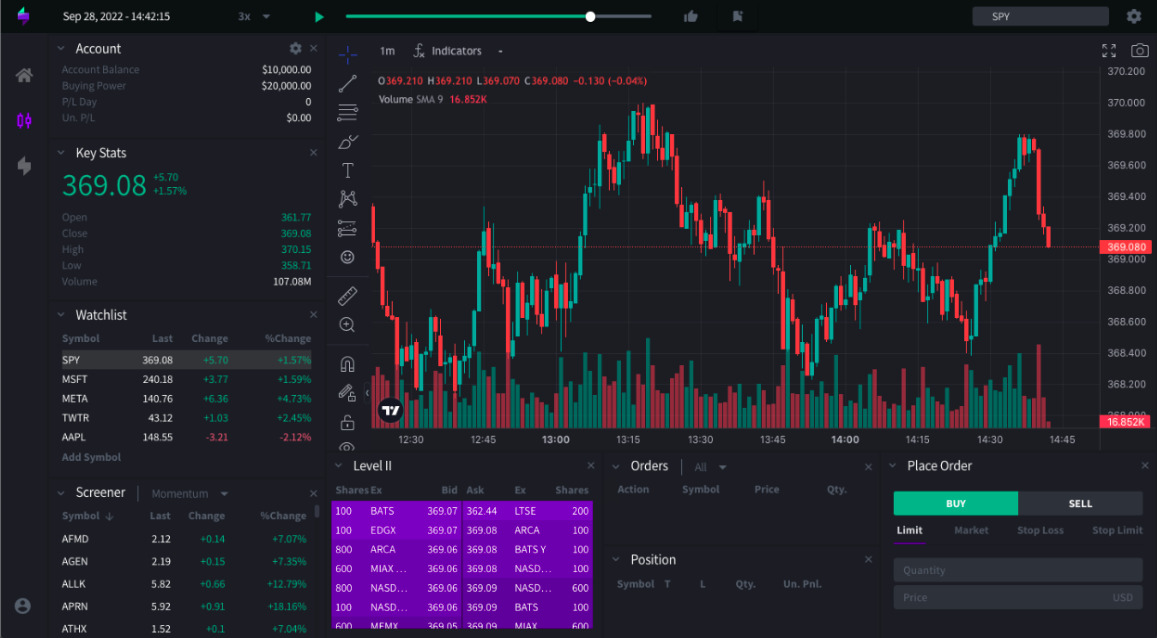

Utilizing resources like a free replay chart tool can aid traders in analyzing past market movements to better understand potential risks. Traders must navigate a myriad of factors—market volatility, economic indicators, and personal biases—all of which can influence trading outcomes.

The ability to quantify risk through techniques such as position sizing and stop-loss orders can be the difference between long-term success and catastrophic failure. After all, even the most seasoned traders encounter unpredictable market movements.

Therefore, integrating a robust risk management plan not only fosters a disciplined trading approach but also instills confidence, allowing traders to embrace market opportunities without fearing excessive loss. Understanding this delicate balance empowers traders to grow, adapt, and thrive in an ever-evolving landscape.

Choosing the Right Trading Simulator

When choosing the right trading simulator, it’s essential to consider several pivotal factors that can enhance your learning experience. First, evaluate the range of assets and markets the simulator offers; some platforms might focus solely on stocks, while others provide opportunities in forex, cryptocurrencies, or options trading, giving you a broader perspective on market dynamics.

Additionally, pay attention to the realism of the trading environment—look for simulators that mimic live market conditions, complete with real-time data and varying volatility levels. User interfaces vary significantly too; a simple, intuitive layout can make your practice more enjoyable and productive.

Finally, don’t overlook community support and educational resources—some simulators come with forums, tutorials, and even mentorship options, which can provide invaluable guidance as you navigate the challenges of trading. Ultimately, the right simulator will not only equip you with practical skills but also empower you to build confidence without the fear of financial loss.

Evaluating Different Trading Platforms

When venturing into the world of trading, choosing the right platform can feel like navigating a labyrinth filled with options. Each platform comes with its own unique set of features, fee structures, and user experiences that can significantly impact your trading journey.

Some platforms boast user-friendly interfaces designed for beginners, while others offer advanced tools and analytics that might suit more experienced traders. It’s essential to examine not just the trading costs and available assets, but also the educational resources, customer support, and security measures in place.

As you sift through your options, consider engaging in trial periods or demo accounts to get a real feel for the platform’s functionality. This hands-on approach can illuminate which system aligns best with your trading style and goals, paving the way for smarter, more informed decisions in your pursuit of financial success.

Conclusion

In conclusion, mastering the art of trading requires time, practice, and a strategic approach to risk management. By leveraging the right resources, such as a free replay chart tool, new traders can hone their skills in a risk-free environment, allowing them to experiment with different strategies and market conditions without the fear of financial loss.

Emphasizing education, disciplined practice, and psychological preparedness will ultimately lead to more informed trading decisions and increased confidence in navigating the complexities of the financial markets. As you embark on your trading journey, remember to continuously refine your approach and remain adaptable to evolving market dynamics.